The law can be a bit complicated for new business owners and entrepreneurs. However, if you want to succeed at something, you must understand its rules. That is why understanding business laws and legal terms is vital to avoid legal issues.

If your company manufactures and sells a product, you must understand what product liability is and how it relates to your business.

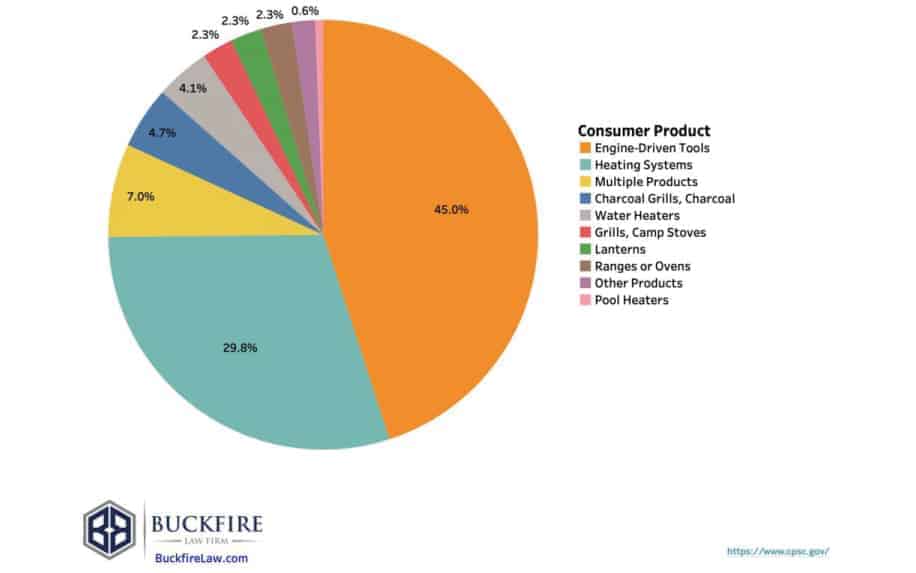

Product defects and recalls can devastate businesses, resulting in costly lawsuits, damaged reputations, and lost profits. For small businesses especially, just one major product liability claim could put the entire company at risk if legal costs and damages awards spiral out of control. According to one estimate, the average product liability claim in the U.S. is over $10 million. No small business wants their company’s future hanging in the balance due to a defective product. This is where product liability insurance can be a lifeline.

Product liability insurance helps protect manufacturers, wholesalers, distributors and retailers against claims and lawsuits resulting from their products causing damage or bodily injury. While product liability policies have exclusions and limitations, they can provide vital protection by covering legal costs and claim payouts. For small business owners, understanding what these policies cover, key exclusions, and how to obtain adequate coverage is crucial. This comprehensive guide will provide an overview of product liability insurance tailored for small businesses.

Let’s start with the basics.

Table of Contents

What is Product Liability?

Product liability is the legal responsibility imposed on a business for the manufacturing or selling defective goods. This is one way our society enforces consumer protection or the idea that consumers shouldn’t be harmed by the products we buy.

If a consumer is injured or harmed by a product, they can file a case against those responsible.

There are principles that a customer can build a product liability claim around. These three theories are a breach of warranty, negligence, and strict liability. Each of these will be explained later in the article.

Who Is Responsible for Product Liability?

The responsibility of selling a defective product may lie on any party delivering the product to the consumer. That includes designers, product manufacturers, parts manufacturers, distributors, or sellers.

This means that customers can often make claims against various stakeholders.

In addition to legal damages, when someone makes a product liability claim against your business, you’ll probably suffer reputational damage. Since this can create serious real-world costs, it’s important to understand product liability and how to avoid it.

What are Product Liability Claims?

As a business owner, you must know where faults usually occur to avoid product defects. The plaintiff must prove that the product was defective, leading to harmful consequences.

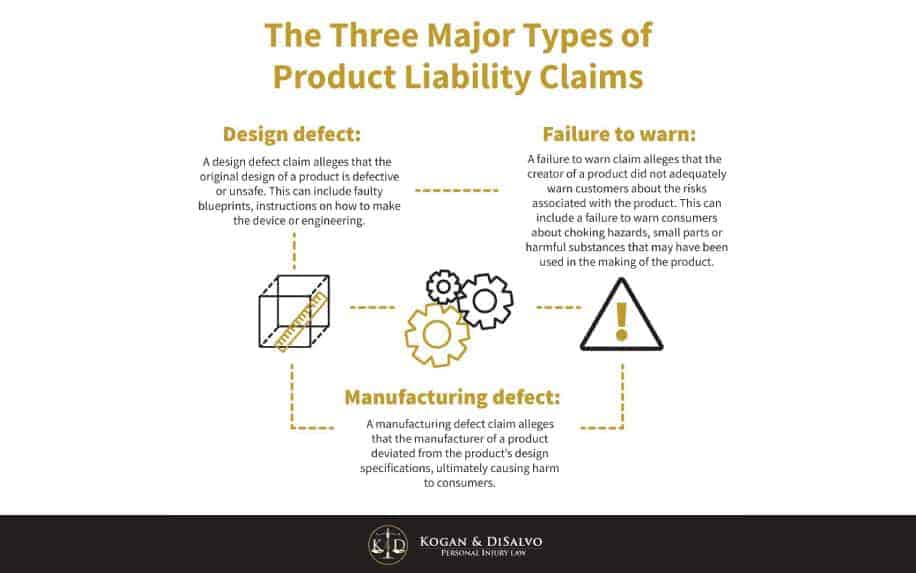

In other words, the consumer has to prove that defects have made a supposedly “safe product” dangerous. There are three areas where defects usually occur:

- Design defects: These faults exist before the product is even manufactured. The design itself is wrong and does not guarantee safety.

- Manufacturing defects: These are unintended shortcomings which occur during the “making” of a product. This happens when the process of manufacturing does not match the intended design.

- Marketing defects: This is the trickiest one. These defects include improper labelling, insufficient instructions, or inadequate safety warnings.

About marketing defects, we should highlight that if your company manufactures or sells products which are dangerous by nature, you need to give the consumer a heads-up.

For example, companies which sell cigarettes warn their consumers that smoking can cause cancer and can lead to death. Even though it may be obvious that smoking is harmful, the company still has to outline this.

The same applies if a company sells knives or medications that should be kept out of children’s reach. The lack of such information would constitute a marketing defect.

The Three Principles of Product Liability Law

Next, you need to know what basis someone can make a product liability claim. During product liability cases, the plaintiff’s claim must be based on one of those three core principles:

Breach of Warranty

Breach of warranty means that the seller (product manufacturer) has failed to adhere to a promise or a guarantee that he made about the product. This theory is only suitable for cases with a signed contract between the seller and the consumer.

However, most products we buy do not require signing a contract, so this theory is rarely used. It is worth mentioning that there are three kinds of warranties. The first kind is an express warranty.

As the name implies, the seller has “stated or communicated” a guarantee to the consumer, even if the word “guarantee” is not uttered or written. The second type of warranty is an implied warranty of merchantability.

This warranty concerns the function a product is intended to perform. For example, scissors are supposed to “cut” things. If a pair of scissors is too dull and cannot cut anything, it has failed to commit to its ordinary purpose.

This is a breach of warranty. The third type is an implied warranty of fitness. This one is related to non-ordinary purposes for products.

For example, if a seller recommends some kind of toothpaste for cleaning your old pair of shoes, this seller has made an implied warranty of fitness. In other words, the seller sold this product promising that it fits your specific need, which is different from its ordinary function.

Negligence

Negligence is the principle theory upon which a plaintiff may file their claim against a company. Negligence means that any responsible party has been careless or failed in their duties.

They either have failed to do something they should have done or have done something they should not have done. The theory extends its care towards a wider circle of those who may be harmed.

To put it differently, even if the harm has not affected the consumer himself but has affected a member of his family, a passer-by, or anyone who holds the product, they still have the right to file a case of product liability.

The plaintiff must prove that the defendant has been careless and that it has caused their product to become dangerous.

Strict Liability

It is fair to say that the previous two theories make it very difficult for the consumer to prove product liability. Breach of warranty is contract law. Therefore, it is unsuitable when a contract does not exist.

Negligence, on the other hand, is extremely difficult to prove. The consumer can never tell when or where the defendant was careless. He cannot prove whether it was the designer’s, the manufacturer’s, or the retailer’s fault.

For these reasons, the law of strict liability has been developed. The law suggests, “If a consumer product has injured you, you are entitled to compensation from the manufacturer or from the business that sold or rented the product directly to you.”

This means that a consumer does need to prove carelessness on behalf of the selling company. Three conditions are necessary for strict liability. First, the product must have a defect that has caused a user harm or injury.

Second, the plaintiff must have used the product correctly and for its intended use. Finally, the plaintiff had not altered the product to affect its performance.

If these three terms apply, the company compensates the plaintiff for the injuries their product caused. On a side note, if a consumer is aware of the product defect yet has continued to use it, he loses the right to claim injury damages.

What Does Product Liability Insurance Cover?

Product liability insurance helps protect manufacturers, wholesalers, and retailers against claims arising from product defects that cause injury or damage. Some examples of potential claims that may be covered:

- A customer is injured due to a faulty design or manufacturing defect in the product. Medical expenses, lost wages, and other damages would likely be covered.

- A product malfunctions and causes property damage. For example, a defective appliance that catches fire and destroys the home it’s in. The policy could cover repair or replacement costs.

- A product recall is required due to a safety hazard. The policy may cover costs associated with the recall, such as retrieval, replacement, and destruction of products.

- Accurate instructions or insufficient warnings about the product’s risks harm a customer. Failure to warn liability claims could be covered.

Section on Excluded Risks and Limitations:

While product liability insurance is broad, some risks may be excluded. Common limitations include:

- Intentional misconduct, illegal acts, or gross negligence by the policyholder.

- Damages occur due to contractual liability through warranties or guarantees.

- Professional services like design, engineering, and testing are done separately from product sales.

- Product recall costs above a limit – often, policies have a sub-limit for recall expenses.

- Gradually occurring losses like wear & tear or gradual environmental damage.

- Claims arising after policy expiration. There is typically a tail period where claims can still be made.

Product Liability Insurance policies:

- Recall expenses

Most policies have a sub-limit for recall costs. For example, the policy may cover up to $100,000 for expenses associated with recalling a defective product. Costs above that would not be covered. - Contractual liabilities

If a manufacturer promises a certain level of performance or offers an extended warranty, claims arising due to not meeting contractual obligations may be excluded. The standard policy only covers tort liability, not contractual. - Components

Some policies only cover the final integrated product. If a part supplied by another company is defective, the claim may be excluded. - Known risks

If a company is aware of a flaw or defect but takes no action, injuries stemming from that known issue may not be covered. There is usually an exclusion for losses arising from knowing disregard for danger. - Product design

Innovative new products that do not have an established safety record can present more uncertainty. Policies may limit or exclude product coverage in testing or alpha/beta stages. - Modified products

Coverage may be limited if an end customer modifies a product significantly from its initial design in a way that contributes to an injury. - Recall of intangibles

Policies typically exclude the cost of recalling or recreating intangible products like software, data, images, or other intellectual property. - Business interruption

Financial losses due to reduced sales or damaged reputation from a product issue or recall may not always be included. Lost profits can be claimed in some cases.

Examples of Risks and Losses That May be Excluded or Limited Under x Insurance Policies:

- Refurbished/Repaired Products

Damage claims arising from products that have been refurbished or repaired may have limited or no coverage. Many policies specifically exclude refurbished goods. - Expired Products

Loss from products used or consumed after expiration may be excluded, for example, expired food products that cause illness. - Crop Loss

Policies typically exclude coverage for crop damage from seeds, fertilizers, or agricultural products. Speciality crop insurance would be required. - Wrongful Advertising

The standard liability policy usually excludes claims of false or misleading advertising of a product’s benefits. Media liability coverage would be needed. - Underground Property Damage

Over time, damage to pipelines, cables, tunnels, etc., is often excluded or requires special coverage. - Blood Products

Given the high risks, any claims related to blood or plasma products are typically excluded. Speciality policies are needed. - E-commerce

Online sales may require special product coverage, as standard policies can exclude internet-related exposures. - Toxic Materials

Many policies limit or exclude asbestos, lead, silica, and other hazardous products requiring speciality coverage. - Drug/Supplements

Due to strict regulations, special liability policies are needed for nutritional supplements and pharmaceutical products.

How Can You Protect Your Business?

Product liability insurance is an option that many businesses consider. There is always a chance for mistakes. For this reason, some companies prefer to secure themselves by having product liability insurance, which covers the costs of any injuries.

Nevertheless, you are better safe than sorry.

You should always maximize safety policies to decrease risk to the minimum. Make sure your company follows a strict quality assurance policy. In addition, give all your employees regular and intensive training to guarantee the best possible performance.

In particular, ensure that those involved in product manufacture and design understand that their job is not easy since it directly affects the consumers’ safety and your company’s reputation.

Your product’s marketing campaigns make promises to your consumers, so you should pay attention to your marketing messages. Your advertisements should be engaging but still truthful and ethical.

Do not make a promise that your product cannot keep. Furthermore, choose your product distributors and retailers wisely. Make sure they are experienced.

Please provide them with enough instructions and details about your product, like how it operates, who it is suitable for, and how to store it safely. Finally, include a reasonable return policy so that your customers can get back to you if there is anything wrong with your product before they use it.

Product Liability FAQ

Q: How much product liability insurance do I need as a small business?

A: Experts recommend at least $1 million in coverage, but $2 million or more is safer for higher-risk products. Consider your revenue, industry risk, and potential claim costs.

Q: Does product liability cover bodily injury and property damage?

A: Both bodily injury and property damage claims from product defects can be covered under a standard policy.

Q: Can I get sued even if I outsource manufacturing?

A: Yes, you can still be held legally liable as the seller or distributor of a product, even if you are outsourcing production. Having product liability coverage is crucial.

Q: Is a product recall covered under liability insurance?

A: Policies may cover recall costs up to a specified limit, often around $100K. Additional recall coverage can be purchased.

Product Liability Conclusion:

With rising costs of product liability claims, lawsuits, and recalls, having adequate insurance coverage is crucial for small businesses today. This guide has provided an overview of how product liability insurance works, key coverages and limitations, and factors to consider when purchasing a policy.

Product defects can happen despite the best quality control. Being proactive about risk management and working with an experienced insurance advisor can help small businesses navigate product liability exposure. The right insurance can distinguish between going out of business or recovering from a product-related crisis. Evaluate risks annually and adjust coverage to match the evolution of your products and sales.